Thursday November 21, 2024

- ALL NEWS

- SMALL & MEDIUM ENTERPRISES (SME)

- INTERNATIONAL TRADE

-

REGIONS

-

NON-REGIONAL

Search

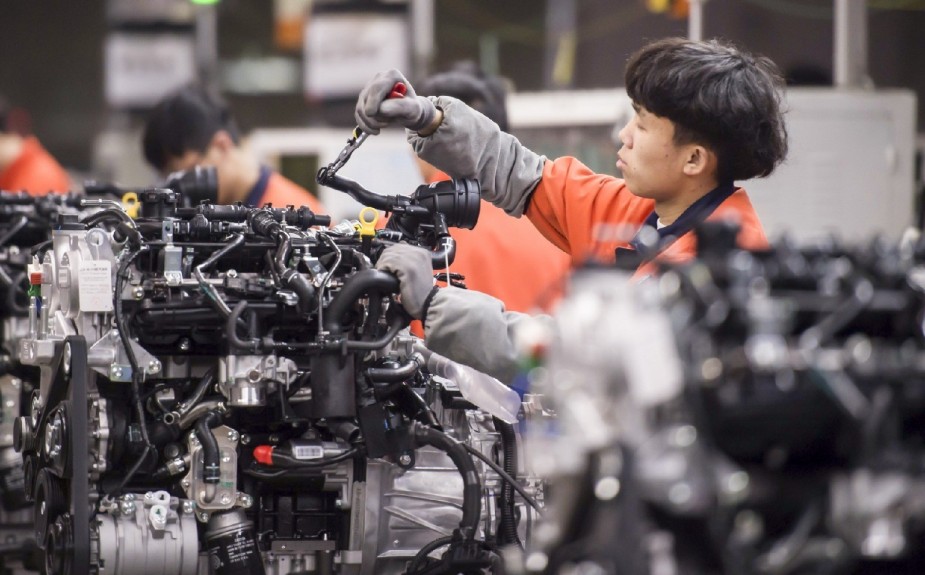

Recent "Zero Covid" policies are a crucial factor that further erodes China's long-standing global trade dominance. China is losing more manufacturing and export market share to Asian neighbors in important areas.

But China still has much going for it as a manufacturing hub developed over the last few decades. Its huge and fast-growing domestic market serves as a strong impetus for investment in the capacity of all types. According to trade experts, Southeast Asian countries and even India still have a long way to go before they can compete with China.

According to several industry insiders, most of the production left China so far is in lower-end processes and has kept China's position as the industry leader. However, they claimed that the pattern is compelling China to modernize its manufacturing to produce higher-value items, which presents both risks and possibilities for local producers.

According to a Chinese trade official, the outflow of foreign trade orders is under control and has had relatively little impact.

Li Xiangqi, director general of the Ministry of Commerce's international trade department, stated during a routine State Council briefing that manufacturing leaving China is "in conformity with the law of economics." Because China has a fully industrial system and advantages in infrastructure, industrial capacity, and professional skill, Li added, China's place in the world's industrial and supply chains is solid. According to him, China's business climate is always improving, and the home market's appeal is only increasing.

According to customs statistics, China's exports increased by 16.9% from a year earlier in May, outpacing experts' projections of an 8% growth and picking up speed from April's 3.9% increase. China's trade surplus increased to $78.76 billion in May from $51.12 billion in April.

Exports increased as COVID-related production and logistical constraints subsided, but the future is still uncertain as global consumer demand slows amid slowing economies and increasing inflation.

Concerns about the sluggish demand in industrialized nations are currently present in all manufacturing bases, including China. The greatest inflation levels in Europe and the United States in the past 40 years have reduced consumers' purchasing power and desire to spend money on non-essential items.

According to some international trade players who spoke with Caixin, neither Southeast Asia nor India can overtake China as the center of the world's manufacturing since they focus mostly on labor-intensive and poor value-added manufacturing. According to analysts, they also deal to varying degrees with issues, including inadequate industrial chains and low worker productivity.

According to He Xiaoqing, president of consultancy company Kearney Greater China, China is a major global business market and a manufacturing hub. He noted that the $900 billion in exports by international businesses in 2020 were dwarfed by the $1.4 trillion in domestic sales, demonstrating the appeal of China's domestic market.

One country that has benefited the most from industries moving out of China is Vietnam, in particular. The nation provides manufacturers with access to the Association of Southeast Asian Nations (ASEAN), a 10-nation free trade bloc, and advantageous trade agreements with the EU, other nations in Asia, and the United States.

Vietnam's exports increased 16.7% year over year in the first five months to $153.29 billion, compared to a strong base in the first half of 2023.

Textiles, furniture, and low-end consumer electronics assembly are the industries with the highest concentration of Chinese manufacturers leaving for Southeast Asia. About 5% of China's orders for textiles, 7% for household products, and 2% for mechanical and electrical items were transferred to ASEAN nations between the fourth quarter of 2022 and the first quarter of 2023.

According to Everbright Securities, among the top 200 suppliers to Apple, 23 companies—including seven from the Chinese mainland—were building plants in Vietnam in 2020, up from 17 in 2018.

Vietnamese electronics firms are still mostly working on low-end assembling at this time. For instance, the Vietnamese division of Lixun Precision, a maker of Apple AirPods and iPhones, focuses mostly on producing connections and computer peripherals. In its plant in Vietnam, the Chinese business Lens Technology produces iPhone glass.

According to Zhang of Transfer, more than half of orders, even though many of them now travel to Vietnam, come from China. According to him, American customers continue to transact business with Chinese firms; the products are transported from Vietnam.

According to Zhang, Vietnam's export capacity is particularly overburdened and needs more room to take on further orders shortly. According to him, Vietnam's fast expansion over the past three years has hit a bottleneck with dwindling benefits in terms of labor and land costs.

Due to the lack of direct shipping boats and the lengthier travel durations from Ho Chi Minh City to Los Angeles than from Shanghai, shipping expenses from Vietnam and Indonesia to the United States are significantly higher than those from China, according to Zhang. Typically, shipping from a Vietnamese port costs $300 more per container than from a Chinese port.

The price differential increased to $3,000 per container in the first few months of this year. In 2018, a factory in Vietnam was established by Deng Shengpeng, whose business manufactures furniture hardware components in Anji, Zhejiang Province. He claimed that this year's soaring shipping prices made it challenging to secure new business.

Vietnam still has far cheaper labor costs than China, but this advantage is eroding due to rising land prices. Deng's Anji plant workers make roughly 7,000 yuan ($1,046) a month and put in 10 hours daily, compared to 2,500–3,000 yuan and 8 hours a day in Vietnam. Deng has also seen a rise in Vietnam's land values recently. A square meter of land costs $20 to $30 before 2018. Now the price is $160 per sq. meter, he said.

The factories of Chinese corporations in Vietnam rely on components and raw materials from China. Production in Vietnam was impacted by supply chains that were stopped earlier this year due to pandemic lockdowns.

According to Counselor's 2023 State of the Industry study, nearly 55% of suppliers claimed that they actively investigated other countries to source from during the previous 12-month period because of trade uncertainties with China.

Vietnam, India, Bangladesh, Indonesia, and Thailand are among Asia's most well-liked sourcing locations.

Additionally, there has been a growing emphasis on nearshoring or relocating manufacturing operations closer to the end market (North America), where goods are marketed and utilized. This, Mexico in particular, has grown in significance as a source region.

Promo executives anticipate China to continue to be the industry's top production hub for the foreseeable future despite some manufacturing relocating there. They say a significant uptick in US manufacturing has been improbable for decades.

Exports News makes it easy for our users to learn more about the latest developments in international trade. Subscribe to our newsletter today to stay informed and up-to-date.

No Comments

Add comment

We’re happy you are satisfied with Exports News. Please let us know if you need enything!

support@exportsnews.comWe’re sorry your experience was not satisfactory. Please let us know how we can improve your experience:

Please contact us with any questions or concerns: support@exportsnews.com

Your feedback has been received! If you have any other questions or concerns, please contact us at:

There aren't any comments yet. Be the first to comment!